Rumored Buzz on Eb5 Investment Immigration

Rumored Buzz on Eb5 Investment Immigration

Blog Article

The 6-Minute Rule for Eb5 Investment Immigration

Table of ContentsGetting My Eb5 Investment Immigration To WorkEb5 Investment Immigration - QuestionsFacts About Eb5 Investment Immigration RevealedA Biased View of Eb5 Investment ImmigrationThe smart Trick of Eb5 Investment Immigration That Nobody is Discussing

Contiguity is developed if demographics systems share borders. To the level feasible, the combined census systems for TEAs should be within one metro area without greater than 20 demographics tracts in a TEA. The combined census tracts must be a consistent form and the address should be centrally located.For more details about the program go to the united state Citizenship and Migration Providers web site. Please allow 1 month to refine your request. We typically react within 5-10 organization days of receiving qualification requests.

The U.S. federal government has taken steps intended at increasing the degree of international financial investment for virtually a century. In the Migration Act of 1924, Congress presented the E-1 treaty trader class to help promote profession by international vendors in the United States on a temporary basis. This program was expanded via the Migration and Citizenship Act (INA) of 1952, which created the E-2 treaty investor course to more draw in foreign financial investment.

workers within two years of the immigrant capitalist's admission to the United States (or in certain conditions, within an affordable time after the two-year period). Additionally, USCIS might credit capitalists with protecting work in a distressed company, which is specified as a business that has actually been in presence for a minimum of 2 years and has endured an internet loss during either the previous twelve month or 24 months before the top priority date on the immigrant capitalist's initial application.

The 7-Second Trick For Eb5 Investment Immigration

The program preserves rigorous capital demands, needing candidates to demonstrate a minimum qualifying financial investment of $1 million, or $500,000 if purchased "Targeted Employment Areas" (TEA), which include specific marked high-unemployment or rural areas. Most of the accepted local facilities develop investment chances that are located in TEAs, which certifies their international capitalists for the reduced financial investment limit.

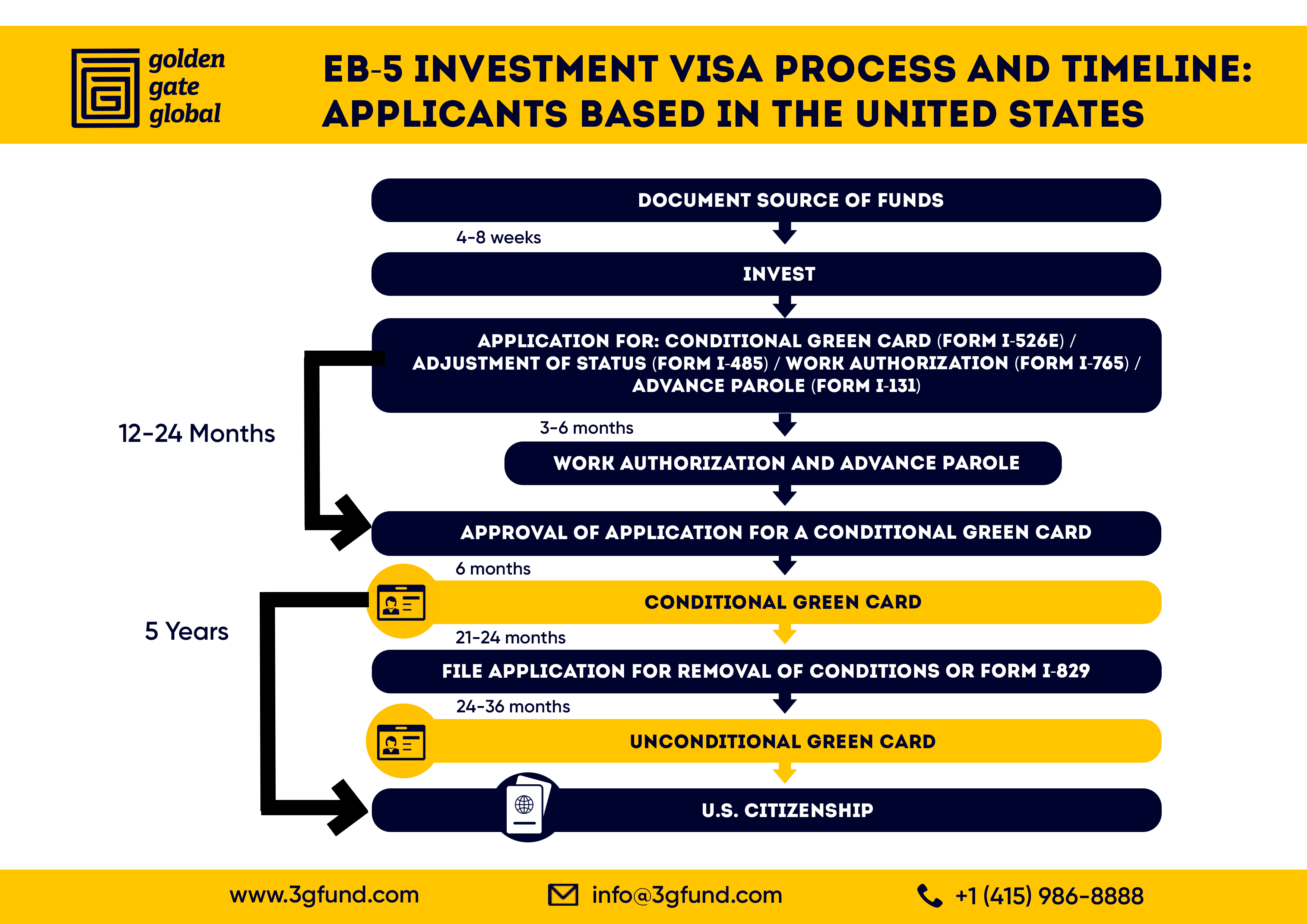

To get approved for an EB-5 visa, an investor should: Invest or be in the process of investing at the very least $1.05 million in a new company in the USA or Spend or remain in the procedure of spending at the very least $800,000 in a Targeted Employment Area. EB5 Investment Immigration. (On March 15, 2022, these amounts increased; before that day, the united state

Extra especially, it's a location that's experiencing at the very least 150 percent of the nationwide typical rate of unemployment. There are some exemptions to the $1.05 million company financial investment. One method is by establishing the investment business in a financially tested area. You might add a lower commercial financial investment of $800,000 in a country area with less than 20,000 in populace.

The Only Guide for Eb5 Investment Immigration

Regional Center financial investments allow for the factor to consider of financial impact on the regional economy in the type of indirect work. Reasonable financial methodologies can be utilized to establish adequate indirect work to fulfill the work creation demand. Not all local facilities are created equal. Any type of capitalist considering attaching a Regional Center have to be really careful to think about the experience and success price of the firm prior to spending.

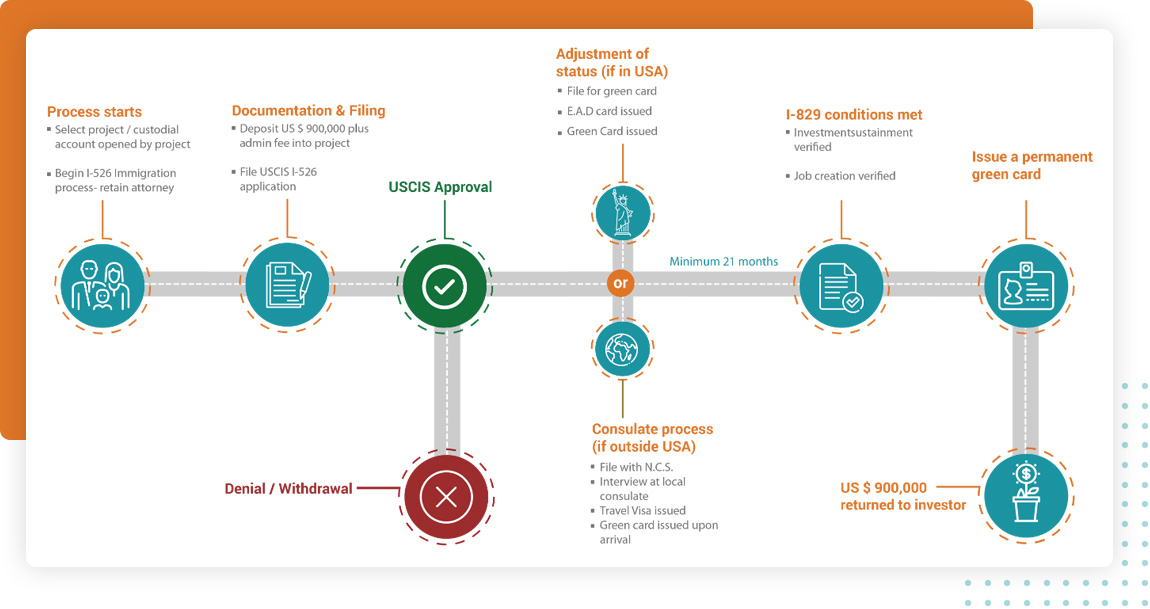

The capitalist first needs to file an I-526 application with united state Citizenship and Immigration Solutions (USCIS). This request has to include evidence that the financial investment will certainly develop full-time employment for at the very least 10 united state people, permanent locals, or various other immigrants that are accredited to function in the United States. After USCIS approves the I-526 request, the financier might make an application for a copyright.

Some Known Questions About Eb5 Investment Immigration.

If the investor is outside the United States, they will require to go through consular handling. Capitalist copyright come with problems attached.

The new section normally allows good-faith financiers pop over to these guys to keep their eligibility after termination of their local facility or debarment of their NCE or JCE. After we inform financiers of the termination or debarment, they might preserve qualification either by informing us that they continue to fulfill qualification demands notwithstanding the termination or debarment, or by modifying their request to show that they meet the needs under area 203(b)( 5 )(M)(ii) of the INA (which his comment is here has different needs depending on whether the investor is looking for to maintain eligibility because their local center was terminated or since their NCE or JCE was debarred).

In all cases, we will make such decisions constant with USCIS policy about submission to prior resolutions to make certain constant adjudication. After we terminate a local center's classification, we will revoke any kind of Type I-956F, Application for Authorization of an Investment in a Company, connected with the terminated regional facility if the Form I-956F was authorized since the date on the regional facility's termination notice.

Excitement About Eb5 Investment Immigration

Report this page